Federal Solar Tax Credit 2018 Irs

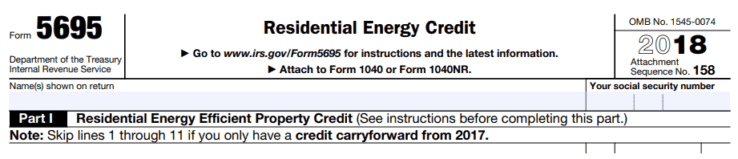

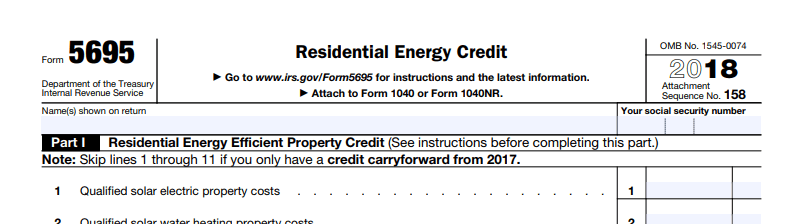

Use these revised instructions with the 2018 form 5695 rev.

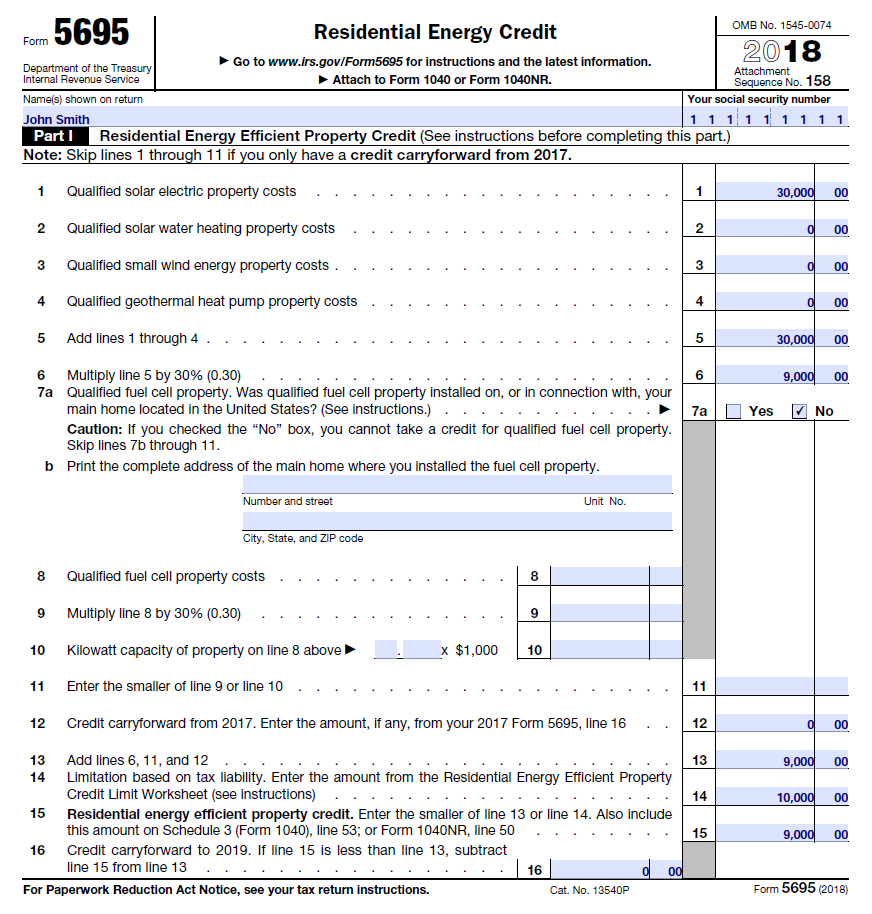

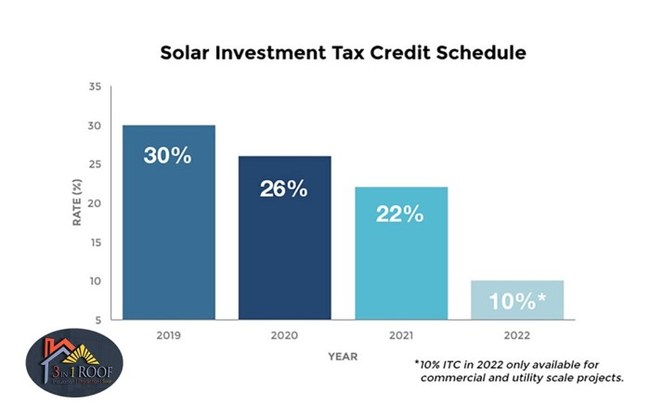

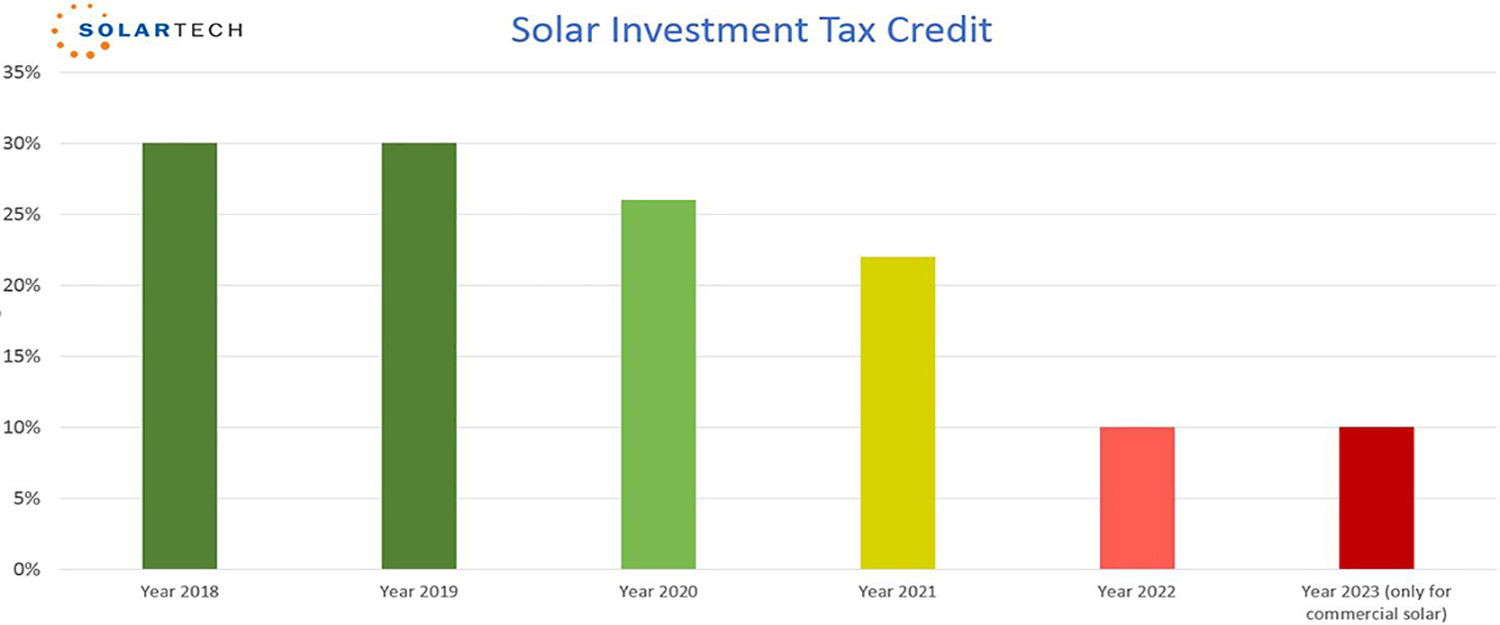

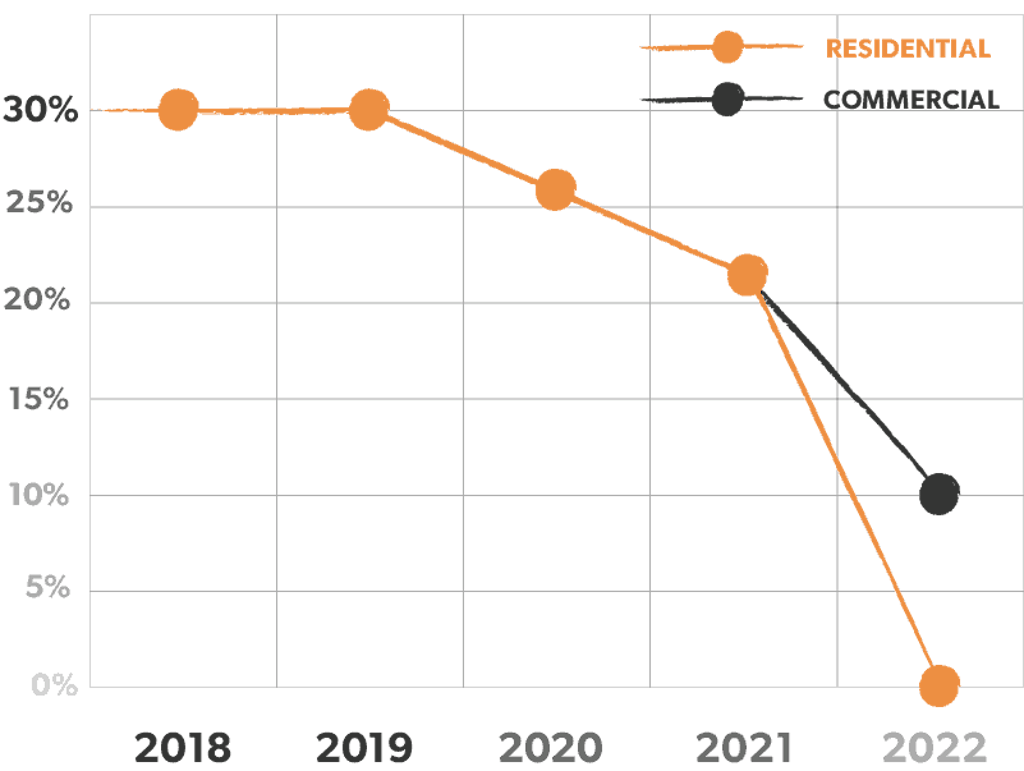

Federal solar tax credit 2018 irs. Form 1040 this is the standard federal income tax form. The solar tax credit is a tax reduction on a dollar for dollar basis. If you owed 5 000 in taxes to uncle sam you would be able to reduce your total tax bill to 2 000 if you invested 10 000 in a new solar powered system. The federal solar tax credit has now stepped down from 30 to 26 for all installations completed in 2020.

If you spend 10 000 on your system you owe 2 600 less in taxes the following year. Filing requirements for solar credits. If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs. These instructions like the 2018 form 5695 rev.

Federal solar tax credit. It s as simple as that. If you re considering solar you ve probably heard about the federal solar tax credit also known as the investment tax credit itc the federal itc makes solar more affordable for homeowners and businesses by granting a dollar for dollar tax deduction equal to 26 of the total cost of a solar energy system. This is a guest post from sarah hancock at best company.

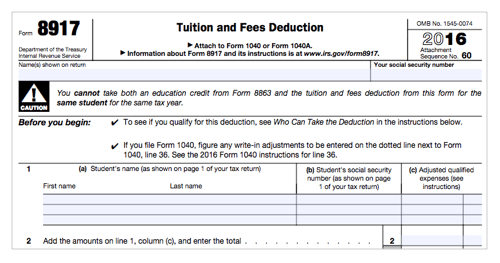

What is the federal solar tax credit. To file your federal solar itc you will need two irs tax forms along with their instructions. To claim the credit you must file irs form 5695 as part of your tax return. The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. It s that time of year again tax time. February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019. The solar tax credit expires in 2022.

You calculate the credit on the form and then enter the result on your 1040. The information below is current for people filing 2019 taxes. How to file the federal solar tax credit in 2018. If say your federal taxes are 6 000 for 2020 and you re eligible for a 7 000 tax credit for installing a solar system at your house you can claim the leftover 1 000 as a credit toward your.

If you have a 1 credit you pay 1 less in taxes. Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file. If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.